This paper reviews findings from a research project examining the role insurance cover (or the lack thereof) plays in disaster recovery. It considers the implications of insurance within a shared-responsibility model for emergency management and disaster mitigation policy and practice. A key finding shows how insufficient understanding of Bushfire Attack Level ratings is exacerbating the problem of underinsurance. The insurance industry has the ability to improve community recovery through greater disaster preparedness efforts. What is needed in Australian emergency management policy is an increased emphasis on disaster mitigation spending, as well as a more holistic understanding of recovery, in which insurance is understood as one tool within a complex process.

Introduction

Insurance is an important element in Australia’s National Strategy for Disaster Resilience (Attorney-General’s Department 2011a, 2011b) that reflects a shift towards shared responsibility for disaster mitigation, preparation, response and recovery between governments, communities and householders (Booth & Tranter 2017, de Vet et al. 2019). Ideally, home and contents insurance supports households to rebuild more quickly, reducing the financial effects and the overall stress experienced after disaster events (Dixon, Shochete & Shakespeare 2015). However, questions exist over the sustainability of insurance as a significant element of emergency management policy (Booth & Harwood 2016; O’Hare, White & Connelley 2016).

This paper summarises three aspects of insurance that are particularly relevant to emergency management and disaster policy and practice. The first is an emphasis on mitigation spending rather than on response and recovery and the role of insurers in a shared-responsibility model. The second is how a lack of understanding of Bushfire Attack Level (BAL) ratings by householders worsens the problem of under-insurance. Third is the role of insurance in bushfire recovery processes.

Arguments derive from findings within a broader research project1 examining the impact of insurance (or the lack thereof) on people’s experiences of disasters. The aim is to understand how being insured can build personal resilience yet increase vulnerability and how to overcome such challenges. For example, O’Hare, White & Connelley (2016, p.1175) described insurance as ‘maladaptive’ and serving ‘to structurally embed risky behaviour’. In a changing climate, the influence of insurance has been found to worsen social inequity by locking in uneven layers of risk within communities (Booth 2018). Most policy foci on insurance emphasise post-disaster responses that rebound to the status quo. They impede opportunities for progressive models of adaptation, such as pre-disaster mitigation strategies that could reduce both the risk and effects of disasters (de Vet et al. 2019).

Of equal concern are the large numbers of households that are uninsured or underinsured (Quantum Market Research 2013). This leaves people exposed to the financial burden of disasters and the related impacts on physical and mental health. These problems can be exacerbated by new housing developments in high-risk areas (Bond & Mercer 2014) and the increasing costs of disasters linked to climate change (Hughes & Fenwick 2015). These changes may place insurance beyond the financial reach of an increasing number of householders. The role of insurance in disaster risk reduction therefore needs to be well understood by policy makers and emergency management practitioners.

Research method

This research first draws on an analysis of official reports and inquiries, policy documents and academic studies into disaster mitigation as they relate to three Australian disaster events (Black Saturday 2009, Queensland floods 2011, Cyclone Yasi 2011) (de Vet et al. 2019). This work highlighted how an over-reliance in government strategies on people having insurance can have negative outcomes for financial security as well as for people’s physical and mental health.

We then examine the empirical research we conducted after the 2013 bushfires in the Blue Mountains of New South Wales (de Vet & Eriksen 2020, Eriksen & de Vet, in review). Four years after the 2013 bushfires destroyed 203 homes and damaged a further 287 homes in the Blue Mountains, 16 interviews were conducted with 17 residents and two local support organisations (Step by Step and Legal Aid NSW). The semi-structured interviews were audio-recorded, transcribed verbatim and thematically coded in the qualitative data analysis software program QSR NVivo v.11. This study was approved by the University of Wollongong Human Research Ethics Committee (2017/323),

All of the households interviewed had some level of home or contents insurance. Five households experienced partial loss and seven endured a total loss of their homes. This work highlights the unintended insurance consequences of BAL ratings and the need for emergency management policy and practice to support the complex psychosocial needs, which get tangled with insurance and homemaking in disaster recovery.

The insurance lifecycle and disaster risk reduction

As described by de Vet and colleagues (2019), the rising costs of disasters have prompted increased debate about how disaster funding should be allocated. In Australia, funding is heavily weighted towards response and recovery, with only three per cent of disaster-related government expenditure going towards mitigation (Coppel & Chester 2014). ‘Hard’ mitigation measures, including flood levees, and ‘soft’ mitigation measures, including information provision and building control measures, have been shown to ultimately reduce overall disaster costs (Shreve & Kelman 2014). According to the Australian Business Roundtable for Disaster Resilience and Safer Communities, an increase of AUD$250 million p.a. in mitigation would more than halve the predicted US$29 billion cost of disasters by 2050 (Deloitte Access Economics 2013). Beyond the financial benefits, mitigation also reduces the likelihood of loss of life, physical injury and long-term mental health effects of disasters, including impacts on emergency management staff and volunteers. Australian national resilience strategies nonetheless remain focused on spending on reactionary activities.

For all levels of governments, this approach assists to balance budgets, but limits opportunities for policy reform (McGowan 2012). Coppel and Chester (2104, p.13) argue that government preference for post-disaster spending is the result of ‘political opportunism and short-sightedness’. Politicians pledging and deploying personnel and resources post-disaster are opportunities for governments to appear generous and strong. At the same time, Australian Government policies place increasing accountability on other stakeholders, as emphasised by the notion of ‘shared responsibility’. The National Strategy for Disaster Resilience states ‘communities, individuals and households need to take greater responsibility for their own safety and act on information, advice and other cues provided before, during and after a disaster’ (Attorney-General’s Department 2011a, p.2).

While the specific allocation of duties within a ‘shared-responsibility’ model remains somewhat ill-defined and the subject of debate, largely absent from discussion has been the role of insurers. Faced with the issue of underinsured in bushfire-affected communities, the Insurance Council of Australia argued that it was the responsibility of governments, not insurers, to better inform householders about policies that might affect insurance levels (Madigan 2016). However, de Vet and co-authors (2019) outline some practical ways the insurance industry could enhance mitigation about cylcones, bushfires and floods.

Cyclones

Unlike floods and fire, there are no large-scale, government-funded hard mitigation projects deliverable on public land that can reduce the force of cyclonic winds (although the construction of seawalls can mitigate cyclone-related inundation). While home retrofits to improve a building’s capacity to withstand cyclone conditions are effective, they are also expensive and could be beyond the means of many householders. This may exacerbate inequitable degrees of risk within communities. Government subsidies for mitigation measures as well as research and community engagement programs on cost-effective retrofits could reduce inequity and increase resilience (Kanakis & McShane 2016). Steps by insurers to reduce costs of cyclone damage could include:

- reducing premiums to householders who undertake retrofits (this pricing mechanism is already offered by some insurers and could be expanded)

- advising householders on actions they can take to improve their cyclone preparedness to reduce their risk and, thus, their insurance premiums.

Floods

In many regions of Australia, government investment in hard mitigation tactics has significant capacity to reduce community vulnerability to floods, more so than any individual household measure. Assuming government investment in flood mitigation, insurers can enhance resilience through appropriate pricing mechanisms. For example, after floods in Roma, Queensland in 2011, the local government constructed a levee planned to protect 483 homes from a 1-in-100 year flood (Urbis 2014). Insurance companies subsequently offered insurance cover for previously high-risk properties in the Roma area and reduced premiums for others. Given that ‘cheaper’ housing stock is often available in high-risk areas (Eriksen et al. In Press), this combination of government funding and insurance re-pricing can reduce flood risk inequity by offering protection for householders with lower financial capacity.

Bushfires

Bushfire-prone areas in Australia are generally covered by soft mitigation measures that include community preparedness programs, urban development restrictions, building regulations and hazard-reduction activities. Hard mitigation measures include home retrofitting of sprinkler systems and fire-resistant materials. The cost of these measures can reinforce uneven layers of disaster risk. Home retrofitting can be expensive, time-intensive and complex. Financial support for retrofitting and research into cheaper materials and designs could reduce risk across a community and, as a consequence, reduce insurance costs. Appropriate pricing mechanisms by insurers, including premium reductions on retrofitted homes, is a way to encourage investment in mitigation measures. This is particularly so when provided in conjunction with information outlining site-specific mitigation actions.

In reviewing policy documents and reports on mitigation, de Vet and co-authors (2019) concluded:

- pre-disaster mitigation intercepts and reduces the likely financial, health and wellbeing impacts of cyclones, bushfires and floods

- reduced costs benefit insurers, who should encourage mitigation measures through insurance premium discounts, information provision and investment in the development of cheaper mitigation options

- effective mitigation is highly dependent on hazard type, as it shapes people’s capacity and role in a shared-responsibility model

- inequity of government support across hazard types needs addressing to improve insurance access and affordability

- mitigation measures are likely to increase insurance affordability and accessibility and contribute to long-term insurance system sustainability.

How BAL ratings increase vulnerability

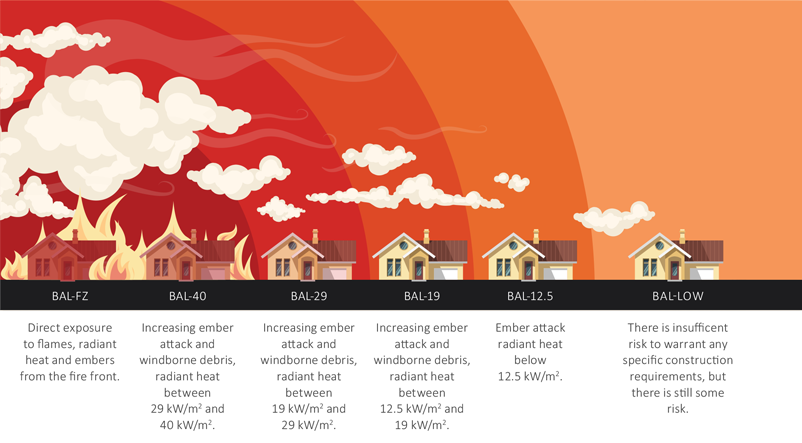

BAL ratings are a key policy mechanism, enforced by state and local governments, to mitigate the risks to property in bushfire-prone areas. A property’s BAL is calculated using property slope, distance from vegetation, surrounding vegetation type and the Fire Danger Index in order to assess exposure to direct flame, radiant heat or ember attack. The Australian Standard AS3959 (Standards Australia 2009) outlines the specific building materials and methods required for the (re)building or renovation of homes in bushfire-prone areas according to a property’s BAL rating. Most homes pre-date Australian Standard AS3959 and so are not built to standard (Penman et al. 2017). Meeting these standards when rebuilding or repairing homes is often more expensive than expected due to the specified use of bushfire-resistant building materials and methods (Lucas, Eriksen & Bowman 2020). While estimates vary, costs may range from an estimated $16,000 for BAL 12.5 to more than $250,000 for new builds with the highest rating of BAL-FZ (AAMI 2015).

According to de Vet and Eriksen (2020), many property owners in high-risk areas remain unaware of their property’s BAL rating and the implications for rebuild and repair costs. Local governments and insurance companies have largely failed to provide adequate resources to allow residents to understand the BAL rating system, access the BAL rating of their home or to calculate likely costs. Only one of the 14 households in the Blue Mountains study was aware before the fire that their property’s BAL rating would increase the cost of a rebuild. Three participants found that they were significantly underinsured as a direct result of rebuilding to BAL standards.

A lack of adequate information on BAL-related costs, along with a failure by insurers to offer risk-reflexive pricing to encourage mitigation, ultimately increased the vulnerability of residents in the Blue Mountains. For example, one couple believed that insurance was necessary in a high-risk area, stating ‘If you’re not insured, then you’re an idiot’. They were certain that their home insurance policy would be sufficient to rebuild. However, they discovered they were underinsured by an estimated $280,000. They had relied on online calculators provided by their insurer and were unaware that BAL building requirements were not included in the calculator’s assessments.

The effects of underinsured are not simply financial but can have debilitating consequences on the emotional wellbeing of people. The rebuilding process potentially adds layers of loss and trauma for people already dealing with loss of their home in the fire and the slow and complex processes of disaster recovery.

In order to reduce the likelihood of negative outcomes, de Vet and Eriksen (2020) recommended possible changes in policy and practice:

by insurance companies:

- Provision of information about BAL ratings to their customers (or potential customers) through online calculators and sales advice documentation.

- Addition of a BAL12.5 rating as a minimum calculated cost for policies in bushfire-prone areas.

- Greater market availability of full-replacement home insurance.

- Appropriate coverage of alternative building technologies, materials and designs.

by governments:

- Greater acknowledgment of, and response to, the consequences of BAL ratings on (in)adequate levels of insurance.

- Increased household knowledge of BAL ratings in bushfire-prone areas, for example, via newsletters, social media posts and by including information leaflets with rates notices.

- Consideration of an automated BAL assessment process through digital mapping technology.

- Consideration of a BAL ‘greenslip’ system, similar to Compulsory Third Party Insurance for car owners.

Wellbeing, insurance and homemaking are entwined

In-depth examinations of the impact of insurance on disaster recovery reveal how insurance is too often assessed purely in financial terms, without proper consideration of its role in people’s wellbeing (Eriksen & de Vet, in review, Eriksen & Simon 2017). People must navigate the sometimes difficult insurance and rebuilding decisions in the aftermath of a highly challenging and potentially traumatic experience. While many participants in the Blue Mountains study reported positive dealings with insurance companies and described the invaluable role of insurance in assisting them reach stability and security, others noted significant challenges that were re-traumatising or that hindered the recovery process. These experiences suggest more holistic approaches to the recovery process that understand insurance as a tool within that process but not as a remedy.

In assessing the role of insurance in their recovery, Blue Mountains residents discussed a range of issues beyond whether or not their policies covered their financial needs. The ease (or otherwise) of the claims process and of personal interactions with insurance company staff were of great importance. Some claims were processed efficiently and with great care. One participant was so grateful for the response from their insurer that they gave the agent a bunch of flowers. Post-disaster, insurance provided ‘peace of mind’ and aided in the ability to ‘move on’. For all participants, insurance enabled rebuilds to be completed within 8 to 24 months and many new homes provided greater stability, with positive benefits for wellbeing. Insurance claims also enabled the building of homes with more space, greater energy efficiency, better appliances and other improved features. Some participants found that their homes increased in financial value once rebuilt.

These positive experiences were not universal. Insurers, at times, failed to adequately adapt their services to support clients recovering from traumatic experiences. Participants’ experiences were not uniform and, more often than not, depended on personal and situational circumstances. This included diverse encounters with fire, including being caught inside a burning house, evacuating while recovering from a caesarean birth and carrying a 12-day old baby, and supporting a multi-generational household through recovery as a single parent. In the days, weeks and months after these traumatising events, rebuilding a home was overwhelmingly stressful. Everyday tasks developed new complexity. Participants reported health diagnoses, such as Post Traumatic Stress Disorder, cancer, autoimmune disorders and depression.

Figure 1: Bushfire Attack Level ratings indicate a building’s potential exposure to bushfires and the severity.

In some of these cases, insurance claims processes intensified personal struggles. For example, one insurer pressured a participant to make decisions quickly with little information at a time when they were mentally and emotionally unable to do so. Another participant found the post-fire experience more distressing than the event itself, describing the insurance assessor as ‘really bossy and pushy and arrogant’. Better training for insurance company staff (and others working with traumatised clients) would assist insurers to reduce the distress of people in recovery as well as prevent the potential vicarious traumatisation of insurance staff.

These experiences offer valuable insights into how emergency management, disaster recovery and insurance providers might understand their roles in supporting the emotional, as well as the financial, wellbeing of their clients. Bushfire recovery is a complex process involving multiple factors beyond the financial focus of insurance. Four years after the Blue Mountains fires, five of the 17 residents interviewed described themselves as still struggling emotionally and physically as a result of the bushfires. This was not a struggle that they thought would be over soon. Insurance had, to varying extents, aided in the recovery of most by helping people to rebuild or repair property. However, greater psychosocial support was needed in order to address the enduring consequences of people’s trauma and loss.

Australian governments rely on charities and other not-for-profit organisations to provide such psychosocial support (Eriksen 2019). These organisations are, however, often underfunded (Australian Red Cross National Disaster Resilience Roundtable 2014) and their roles are inadequately accounted for in disaster management frameworks (VCOSS 2017). Addressing these problems in policy is an important step towards holistic support for communities affected by disasters. The experiences of residents in the Blue Mountains (Eriksen & de Vet, in review), and more recently in many other parts of Australia (Lucas, Eriksen & Bowman 2020) suggests the need for a more holistic approach to emergency management. Insurance should be situated as one element in a range of disaster risk reduction strategies, assisting people to navigate the complex terrain of disaster mitigation, response and recovery.

Conclusion

The centrality of the role of insurance to Australia’s disaster resilience strategy is based, first, on a model that emphasises post-disaster response over pre-disaster mitigation and, second, on the framework of shared responsibility that inadvertently shifts costs onto households and away from government. As a result, opportunities to prevent disasters or to reduce their effects through hard and soft mitigation measures are lost. This ultimately increases the costs of disasters and escalates the harmful, non-financial impacts on households as well as on emergency management practitioners and volunteers on the front line. With housing development expanding into at-risk areas and the increasing intensity and frequency of extreme weather events, this model is arguably unsustainable.

This is not to say that insurance should have no role in emergency management policy and practice. As the Blue Mountains study shows, insurance provides valuable support in helping people rebuild and, when conducted sensitively and with appropriate consideration of ongoing distress, aids in both financial and emotional recovery. Instead, insurers should take a greater role in mitigation measures, including through education and engagement programs and by offering reductions in premiums on retrofitted homes. By actively working to reduce costs through pre-disaster spending, insurers can support the ongoing sustainability of their industry while reducing impacts on communities.

Most significantly, a re-imagined role for disaster insurance could acknowledge that recovery from the trauma of bushfires, floods, cyclones and other hazards is far more than a financial process. While arguing for a greater emphasis on pre-disaster spending, a shift in post-disaster response that acknowledges the value of psychosocial support services is also needed. A holistic approach to disaster recovery should reduce consequences through mitigation, address the social inequities that increase vulnerability, adequately fund the work of post-disaster support agencies and, in doing so, acknowledge the complexity of physical, mental and emotional recovery processes.